5 things to know before you buy a HDB in Singapore

Buying a house is a dream harboured by every adult. Having your own home is a matter of pride and gives a sense of security. But along with all the happiness, it is also one of the most important financial decisions you will make in your life.

Unless you have inherited buckets of cash, it is extremely crucial that you understand all the basics of property buying before you venture out to buy your home so you don't waste a single cent. After all, every penny counts!

1. The basics and the background of houses in Singapore

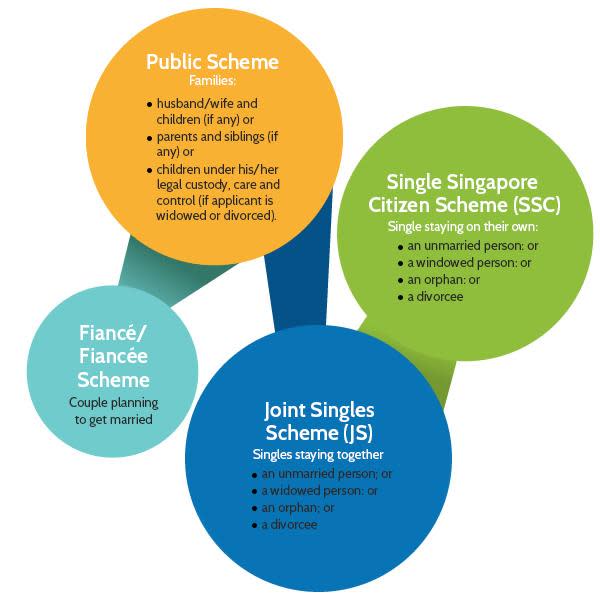

Singapore’s housing market is unique as over 80% of Singaporeans live in HDB (Housing Development Board) housing. HDB allows Singapore citizens and PRs to buy homes at subsidised rates under various schemes.

It is essential to understand what scheme to apply for and the eligibility criteria for the same. The major channel of acquiring an HDB flat is through purchasing a new flat via BTO (Build-to-order) programme.

There is also the option of buying flats under resale if you can’t wait for the average 3 years it takes for a BTO flat to be delivered to the buyer.

2. How to finance your first home in Singapore

Unless you are drowning in money it is always advisable to take a loan for financing your purchase of a home. There are two options for a prospective borrower:

Bank Loans

HDB Loan

Bank loans have become increasingly popular in the last few years as they had a lower rate of interest than HDB. But a caveat is that bank loans require at least 20% upfront versus the 10% upfront for HDB loans.

With the low-interest rate environment over, financial analysts estimate that interest rates are on an upward trajectory. This suggests that unless you are getting an extremely lucrative interest rate from your bank, HDB loan is the way to go.

You can also consult with a mortgage broker to ensure that you get the best deal. There are more than a hundred banks in Singapore and only a professional will have the knowledge about the best interest rate deals available.

3. Buying your first home: credit scores and TDSR

Every bank and even HDB will analyze your ability to repay the loan. The two major factors are your credit score and Total Debt Service Ratio (TDSR).

If you don’t know you your credit score, get one today from Credit Bureau of Singapore after paying a nominal fee of S$ 6.42. Even if you are planning your purchase after a few years, you should start building up your credit score.

It is essential to pay all your debts and credit card liabilities on time. Having a poor credit score can cost you thousands of dollars in higher interest rates.

TDSR measures the percentage of your income utilised in paying off your loans. Your repayment cannot be higher than 60% of your income after factoring in all (personal, car, housing etc) loan repayments. Read more about TDSR here.

4. Remember to consider the affordability when buying your first home

Source: PIxabay

Everyone wants the biggest home in the best location but it is essential to be conservative. Recent hot spots like Bidadari, Tampines and Punggol would be higher priced than other “inconvenient” areas.

But weigh your opportunity costs too. Does it makes sense to pay an additional S$500 a month for a location closer to work? To some, it does. To others, it may not make sense and they don't mind the longer commute.

It is always best to buy a home that is well within your affordability range as you want to have some spare cash for other investments. Yes, location is important, but so is finding a home that is right for you.

5. After buying your first home, ensure you have an emergency fund in place

Even after the initial deposit of 10/20%, you should have at least an emergency buffer of 6 months expenses. This is vital to ensure that you are not left in an extreme cash crunch due to any unfortunate event.

Being laid off or suffering an injury can be a harrowing experience in itself. Having no backup funds will only compound the problem. Ensure you have the right insurance in place to safeguard and hedge against unforeseen circumstances.

Purchasing a new home is an enriching experience. But it is crucial that the buyer is researching thoroughly and exercising caution at every step of the way. You are probably taking the most important decision of your life; you need to get it right.

(By Heena Dhir)

Related Articles

- 5 tips for reducing stress when taking out a home loan

- Reading the fine print on your home loan: 7 essential clauses not to miss

- How to purchase a resale HDB flat in Singapore

Yahoo Finance

Yahoo Finance